The Mechanics of Unbundling - Part I

A Deep Dive Into how Horizontal Platforms Truly Become Unbundled.

How many $5B+ companies is LinkedIn going to produce?

Harry's highly debated tweet is referring to the strategy used by budding startups to disrupt incumbent horizontal platforms. By cherry-picking a specific problem and providing a solution with greater depth, the vertical approach, in theory, provides a better experience and splinters the sub-network from the incumbent.

eBay and Craigslist are canonical examples of where we’ve seen this strategy play out. Airbnb, Zillow, and Poshmark, among others, incisively found underserved niches within the respective platforms and have produced billion-dollar-plus outcomes. So it’s no surprise that investors, founders, and tech evangelists are paying close attention to this trend. Pundits claim that a similar phenomenon isn’t solely eroding LinkedIn though, but Amazon and YouTube are equally as vulnerable.

Regardless of the side that you stand on, after reading through the deliberation of Harry’s claim, it’s clear that further explanation is needed.

Similar gripes and arguments were made in the mid-2000s regarding eBay and Craigslist. Any Google search will reveal an abundance of them. Poor UX / UI is not an adequate justification as to why platforms splinter, though; They're symptoms of deeper-rooted problems; Problems that persist across platforms experiencing competition in the form of verticalization.

Fortunately, we have the benefit of time to explore these problems. Years have passed since the last great unbundling of eBay, and Craigslist began. Exploring where each platform stands today reveals some surprises: Craigslist's revenue is 6x higher than in 2014 when many predictions of its demise were made. Meanwhile, eBay's top-line revenue is $87B, more than almost all leading verticalized marketplaces combined.

*Pulled from eBay’s annual investor report

Of the challengers that tried to unbundle Craigslist, only a handful have grown to be as large or larger than the incumbent, while many have failed altogether.

With historically inaccurate predictions, continued incumbent growth, and a slew of failures, it raises a few questions:

How do incumbent platforms maintain their authority?

When does a vertical solution make sense, and what increases its chances of success?

If poor UX / UI isn’t the actual issue, what is? Do we understand the principles of unbundling platforms?

Surprisingly, answering these questions returns few results, and the principles of unbundling have yet to be intimately examined. Although this article may be a grand simplification, exploring the past reveals a framework for entrepreneurs and investors to ask and answer the questions that matter most.

Over a series of four parts, we will explore unbundling digital platforms and gain a deeper understanding of how horizontal platforms splinter. We will find that:

The success of verticalized marketplaces depends on both market saturation and network saturation. Both are mutually exclusive characteristics of a digital marketplace. Saturated networks make for prime targets to unbundle, especially if there is a large delta (or through market expansion) on the incumbent platform.

Platforms with many platform dimensions serve as a compass as to which opportunities are ripe for exploiting. It also serves as an indicator of how likely and quickly an incumbent can react to a challenger.

Marketplaces’ transaction size, frequency, and potential market size determine whether a vertical or horizontal approach is appropriate.

Market Saturation Vs. Network Saturation

Craigslist, over the past ten years, has more than 6x revenue to $700M and is up 20% compared to last year. If you were surprised to read that, you're not alone.

So, how hasn’t it failed yet?

We must note that Craigslist is not a monolithic network but a network of networks. Each network, whether it's Seattle, New York, or Asheville, North Carolina, is its own ecosystem, possessing unique characteristics to that individual market. Collectively, they sum to equal the entire network and value of Craigslist.

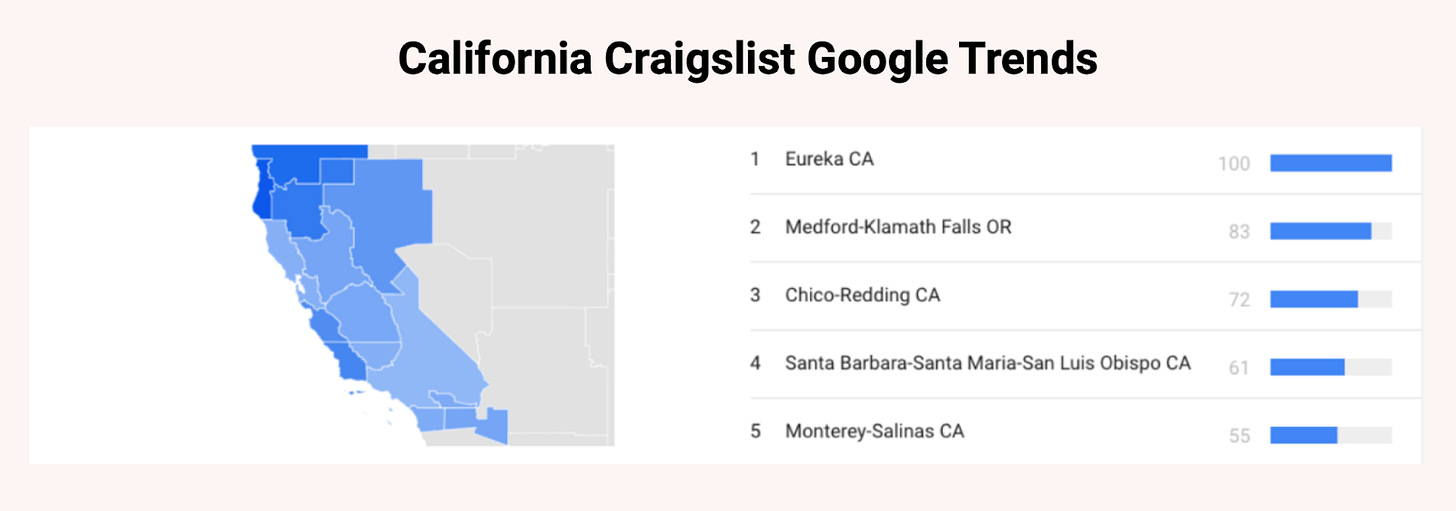

Looking at Google Trends, as of 8/22, we find that Craigslist is one of the few platforms where rural states far outrank populous ones regarding Google Trends popularity. Even California doesn't appear until 20th overall.

Inspecting California further, we see a reinforcement of this trend at the local level. Los Angeles and San Francisco, actually rank last out of the 14 geographies that Google segregates and tracks.

The trend of Craigslist being more prevalent in less populated areas and the inverse in populous ones starts to emerge as far back as Google's data can take us. Sampling the United States' most densely populated cities (New York, Los Angeles, Chicago, Dallas, Boston, and San Francisco) against the bottom 20 least populous states, we see the two cohorts trade positions.

*Values were computed by pulling data from Google Trends and calculating the mean.

One might point out that technology generally originates in coastal hubs and works its way inwards to more rural areas. Data from platforms that have been around for an equal duration, however, dispel this assumption as false. As an example, below is the same chart for eBay.

*Values were computed by pulling data from Google Trends and calculating the mean.

eBay's popularity reveals trends that fly in the face of the behavior we see from Craigslist. These graphs and data indicate that Craigslist, as much flak as it receives, is working quite well for a subset of the population and that the reason is unique.

So what is the reason?

As with any growing marketplace, the network effect is tapped as the platform grows larger. More suppliers join, which creates more optionality for consumers and more consumers drive more suppliers. The flywheel repeats. For large cities, such as the ones we’ve sampled, the market size and thus the potential network size is orders of magnitude larger than that of rural markets.

In New York, Chicago, etc., so many suppliers and consumers joined that they started overcrowding what the platform could handle. This overcrowded, saturated network results in suppliers taking longer to match with the proper demand, unturned inventory, spam, and eventually, churn. Those that experience the effects of overcrowding opt for a vertical solution, even if the cost of doing business is higher.

What is happening is that Craigslist's network cannot support the respective market. As a result, the carrying capacity, or the threshold that a platform can support that allows suppliers and buyers to transact effectively, has been eclipsed, which leads to the network (or sub-network) being saturated. Said another way, it's much easier for Craigslist to support 1,000 listings, which might be the entire market of Asheville, whereas it is more complex to support 50,000, which might be the market of New York or Los Angeles. After the threshold is met and surpassed, the experience deteriorates.

In rural markets, such as Asheville, Craigslist's platform can appropriately support the market since the number of suppliers/consumers do not, and in most cases, will not eclipse the carrying capacity. This explains why Craigslist's most popular states, according to Google Trends, are Montana, Idaho, New Mexico, Oregon, etc., Because it's still a viable option for conducting commerce effectively.

To further the point, we can see another example of this in the listings across different-sized cities. Listings were pulled across four categories and divided by the population of each geography and then normalized to the lowest common value. For example, Chicago has 1 appliance listing for every 5000 people, whereas Asheville has 1 for every 357, a 14x difference.

4 randomly chosen categories across sections that would have low demand variability across geographies. For example, a car wouldn’t be a suitable choice for Chicago because fewer people drive cars. The values are calculated by dividing the total listings per category by the respective population per geography. The results are then normalized with respect to the lowest value.

It's unlikely that Asheville's appliance demand is 14x higher than Chicago's and 3x higher than Charlotte's. We can posit the same for bikes, furniture, and housing. The number of suppliers choosing Craigslist is multiples higher the less populated the geographic area.

We will share more fidelity in Part III of this article as to why using Craigslist in rural areas makes sense as opposed to a vertical solution (for both the demand and supply side), despite the experience being objectively better, but to provide a preview: It’s cost. Vertical solutions charge a premium because they do not reap the benefits of bundling (read Chris Dixon’s post as to why bundling isn’t going anywhere).

These points are not to protest that Craigslist will be around forever, though. Again, this article is a grand simplification that is intended to pry at the structures that underpin unbundling. One might provide a counter-argument that vertical marketplaces don’t target consumers in more rural areas. This plays a part, yes (included in Part III) but the categories (with the exception of housing) listed above are also global in nature. I.e. they do not require a local marketplace to conduct commerce. Therefore, the value of acquiring a rural user is comparable to that of acquiring one in a larger, metro area.

Before continuing, it's important to fully grasp the difference between network and market saturation as it explains more than which opportunities might be ripe to verticalize.

Network saturation is the number of suppliers and consumers a platform can support or what the network’s carrying capacity is.

Market saturation is the total number of suppliers and consumers in the market itself.

The goal for any platform is to build a product that maintains a carrying capacity above the market saturation point, thus being able to capture the majority or entirety of the market. Note that the network saturation/carrying capacity is also variable. Product features and enhancements can be made to a product that improves the ability of suppliers and consumers to conduct commerce effectively and thus increases the bar for network saturation.

In the case of eBay, the carrying capacity for sub-networks that have been picked off and vertically integrated, such as tickets, cars, collectibles, sneakers, and reused clothes, have lower carrying capacities than commodities that drive the bulk of GMV for their business today. We will explain more as to why this is in Part II.

We've established that carrying capacity is important, but it's the difference and variety of carrying capacities (i.e., networks) across the incumbent's bundled platform that makes them slow to react and attractive to disrupt or unbundle. Because bundled platforms have different carrying capacities across sub-networks and categories within those networks, developing product enhancements to increase carrying capacity proves challenging. For the incumbent, it's often not worth investing in the countermeasures, as they may only serve a subset of the overall network. We will explore this in more detail in Part II.

The analysis of Craigslist competitors 2011 Vs 2022 is misleading.

Some of those companies that "failed" had pretty great outcomes. For example, CodeAcademy sold for over $500 million - not bad for a media business! Elance and Odesk merged and rebranded as Upwork, currently worth over $2 billion.

Really enjoyed understanding the 'Density' part, and how Network Density can kill a Network - till now I always assumed 'More Dense' -> The better, but in case of Craiglist - More is Not Better - as handling more density poses different Set of Challenges.

Do you think a Better Discovery Mechanism can help solve Dense Networks?