The Q1 Fundraising Environment & Which Trends are Hot🔥 and Cold 🧊

Q1 left an indelible mark on the tech and venture ecosystem. Aside from the banking crisis and SVB’s sudden collapse (which has been more than well covered), the fundraising environment marked a measured decline compared to 2022 and years prior, with some stages posting historically low numbers.

With funding rounds continuing to decrease, the analysis underscores how challenging it has been for founders (especially at growth stages and in emerging markets) to raise capital.

Q1 Fundraising

Seed through Series C have each experienced at least a 50% decline in the number of rounds completed compared to Q1 last year. Benchmarking where these numbers fall relative to each Q1 since 2010, and these numbers become historic.

Seed hasn’t experienced fewer funding rounds since 2010, and Series A isn’t far behind. As dramatic as the pullback has been on the early side, the impact on later stage has been even worse. Series Bs and Cs haven’t reached marks this low as far as the data took us back.

Outside the US, capital in emerging markets has all but dried up. Across LatAm’s five most notable active tech geographies (Brazil, Mexico, Colombia, Argentina, and Chile), completed only 2 Series Bs in the first quarter and 0 (yes 0) Series C rounds.

The same is true across other emerging markets, such as Malaysia, the Philippines, and Vietnam, contributing 1 later stage round (Series B/C) during Q1.

Despite the precipitous fall in rounds, round size, surprisingly, has remained relatively static and hasn’t been corrected.

Above is a look at seed and Series A round sizes since 2015. Notably, the mean round size is consistent with that of 2022. As investors flock to quality and optics, founders that can raise are in a position of leverage and have commanded higher prices.

Later rounds, which have been hit the hardest regarding volume, share a similar experience, with round size staying within a 15% deviation from all-time highs.

In speaking with downstream investors, sentiment is mixed as to whether or not Q2 will produce higher output in terms of the number of rounds. With the number of startups that raised Series A rounds in ‘21 and ‘22, raising a B will prove challenging, and late-stage investors will have their pick.

Q1 - Stock Up / Stock Down

I mean, how could you start with anything else? Each week, there seems to be a new and exciting development in the market.

Over the past quarter, not did OpenAI release GPT-4, the advent of the underlying model that powers ChatGPT, but also plugins, which demonstrates the platform potential of the technology (more on this below). For those living under a rock and hearing about the capabilities of the technology for the first time, GPT-4 has already proven to do some amazing things. One of my favorites is below:

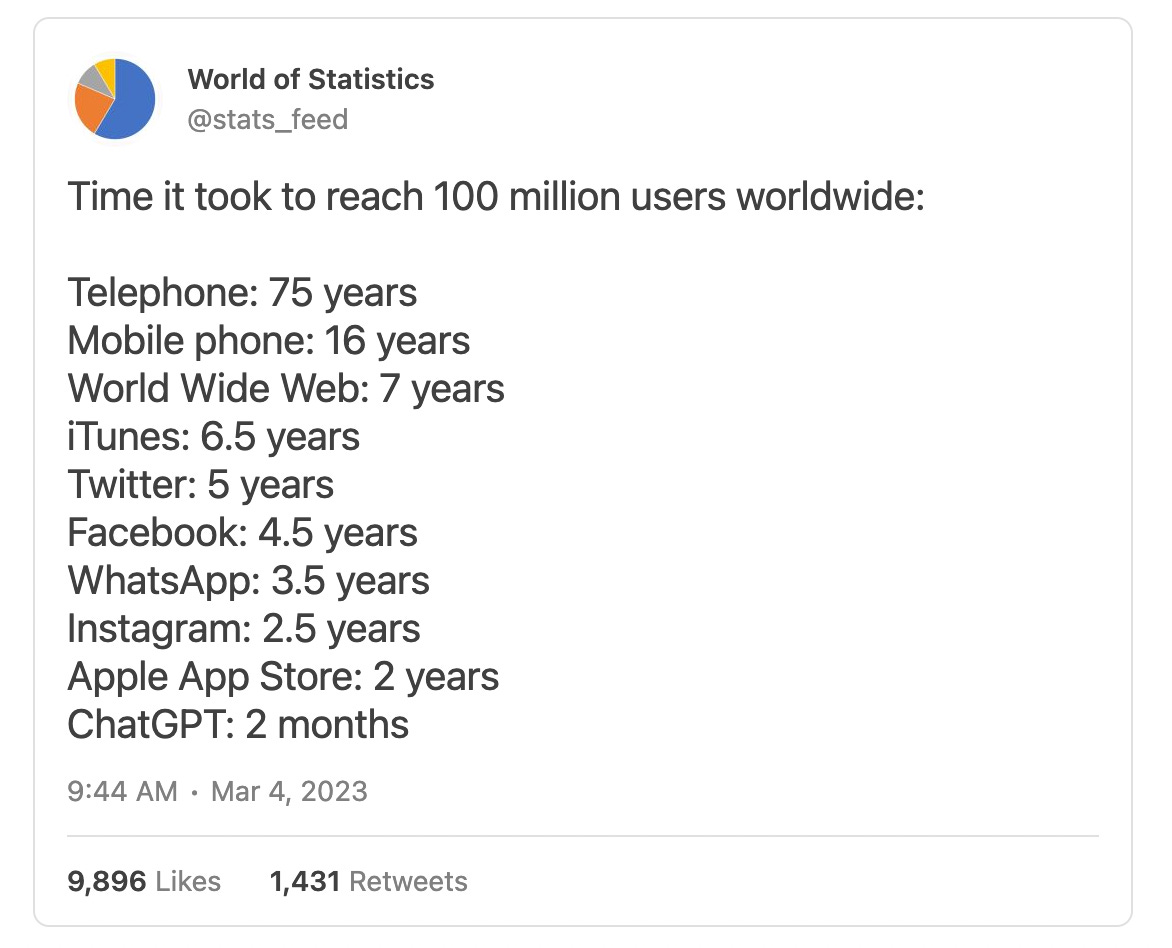

The speed at which chatGPT has been adopted has been faster than any other application in history by a wide margin. Adoption of the technology in the enterprise also only accelerated in Q1 as well. Microsoft, Google, Snap, Meta, Adobe, and ZoomInfo are a handful of the many names leveraging generativeAI to enhance the UX and productivity of their end customers.

On the startup side, of the 7 newly minted unicorns in the US, 3 are generativeAI startups: Adept, Character, and Anthropic all joined the club.

Despite the excitement around the technology, the market also faces its challenges. A petition created by the Future of Life Institute and endorsed by Elon Musk and Steve Wozniak called for OpenAI to halt the advancement of more sophisticated models beyond GPT-4. Over 1000+ top technologists and scientists have joined Musk and Wozniak in hopes of preventing GPT-5 from being released, which OpenAI claims will be later this year and will achieve AGI.

Some are taking more drastic measures, such as banning the app altogether. Italy became the first country to ban ChatGPT and others have been rumored to follow suit until they can better understand AI’s effects on their respective economies.

Regardless, it’s clear that we’re at the beginning of a renaissance by the likes of which we have not seen before. For those who are curious about how ChatGPT works, Stephen Wolfram’s article is a great resource.

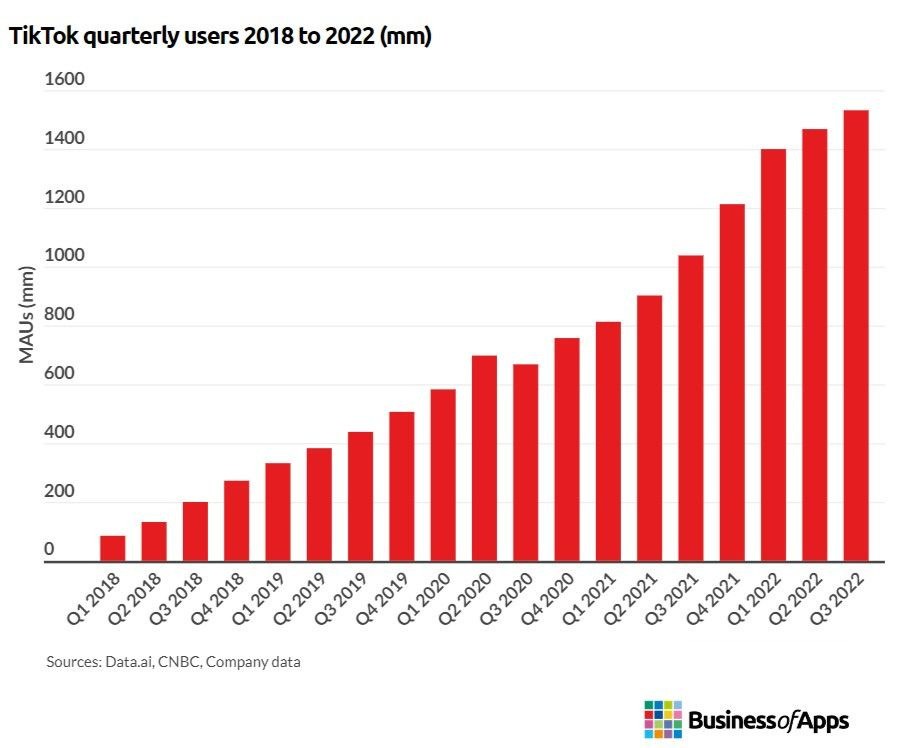

TikTok overtook the #1 spot on the iOS AppStore this past quarter. The app currently counts over 150M users in the United States and more than 1.5B worldwide.

Despite its popularity, TikTok’s days in the US may be numbered. Although this may sound like deja vu from Trump’s attempt in 2020, the Biden Administration has finally stepped in and announced that it was forcing the Chinese-run company to divest to a US company or be shut down. Their arguments rest on two quarrels:

Concerns over private user data, such as location data, are being shared with the Chinese government.

The spreading of misinformation about the CCP’s agenda via TikTok’s algorithm.

Noah Smith provides more context around the move to ban the app in one of his most recent articles, and the NYT does an excellent job talking about this trend globally, as the US is not the first country to pursue banning the app.

If TikTok chooses not to sell to a US-based company, a ban would have implications on tech. Starting with the most obvious: the opportunity for new and existing social apps to acquire users. The average TikTok user spends 95 minutes daily on the app, making it the most addicting social app and increasingly lucrative for advertisers.

TikTok raked in $11B this year with expectations to greatly exceed that figure as more US consumers start their shopping journey on the app.

A US economy absent of TikTok would mean millions of minutes per day are now up for grabs, and the advertising revenue comes with it. Big tech will obviously benefit from this, and Snap and Meta have already seen slight rebounds in their stock prices. But it’s also an opportunity for startups looking for their next inflection point of growth. Startups like BeReal and Poparazzi are worth keeping an eye on, as well as other startups that brands can leverage to acquire customers.

Not all would benefit, though. Startups with platform dependencies on TikTok, such as marTech platforms connecting TikTok creators and brands, will see this line of business go to 0.

The timeline for such a ban is still unclear, but something worth keeping an eye on over Q3.

What are ChatGPT plugins, and why is it so powerful? According to ChatGPT:

ChatGPT plugins are additional features that have been integrated directly into the ChatGPT system. These plugins expand ChatGPT's capabilities and allow it to perform new tasks beyond its standard conversational abilities.

The available plugins include:

1. Browsing: This plugin enables ChatGPT to browse the internet and access web content when it is appropriate to do so in a conversation. For instance, if the user asks a question that requires a web search, the browsing plugin can be activated to find the relevant information.

2. Code Interpreter: With this plugin, ChatGPT can execute Python code and perform actions like uploading and downloading files, making it useful for developers who want to test their code or perform other programming-related tasks.

3. Retrieval: This plugin enables ChatGPT to access and retrieve information from personal or organizational sources, with the user's permission. For instance, if the user asks for a particular document or file, ChatGPT can retrieve it for them.

4. Third-Party Plugins: This plugin allows ChatGPT to use additional third-party plugins that may be available, which expand its capabilities even further.

Overall, ChatGPT plugins enhance the AI's functionality and allow it to perform a wider range of tasks, making it more versatile and useful in various contexts.

With the release of plugins, ChatGPT has absorbed the functionality of many of the generative AI companies building on top of OpenAI and finishing up YC’s most recent batch.

Packy McCormick summed up the effect this has on those building on top of ChatGPT nicely:

If the Intelligence API lets companies bring OpenAI’s intelligence into their products, then plugins let companies turn themselves into APIs that feed OpenAI’s Intelligence. Any product, entire big and small companies’ products, essentially become APIs that OpenAI’s users can automatically hook into their personal Action Engine.

All of a sudden, with the right plugins, ChatGPT can do many of the things GPT Wrappers can do. Thanos snapped

Remember when the metaverse was supposed to be the next big thing? In October 2021, Facebook bet the company's direction into the concept by rebranding itself to Meta and forming Reality Labs. Unfortunately, reality Labs has posted a cumulative loss of $24B between 2021 and 2022, with $13B last year alone.

The spending has achieved less than desirable results. Multiple times, Meta has shifted growth targets for Horizon, Meta’s platform, which started at 500K MAU and has since diminished to 200K MAUs. Retention remains the chief concern, though - a rare issue for their flagship products. Some have claimed weekly retention stood just north of 10% weekly, and now patience is thin.

Not even 1.5 years into the strategic shift, Mark Zuckerberg has realized that the metaverse will have to wait and that GenerativeAI is the conquest to endeavor.

Aside from Meta, who has aptly led the charge, others also have questioned the metaverse’s prospects and responded accordingly. For example, Disney recently cut their metaverse division in a cost-cutting effort, while Microsoft has also signaled that they’ve cooled on the idea.

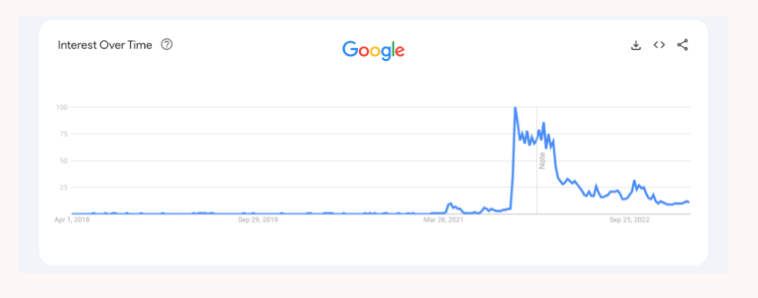

The public also has begun to lose interest as popularity on Google dwindles.

The U.S. Bureau of Labor Statistics recently released data indicating that working from home is becoming increasingly rare in the US workforce. Since 2021, there’s been a 20% jump in the number of rarely remote employees to 76%, a figure that continues to climb. In addition, spurred by a pending recession, worries across firms’ management about their employees’ productivity have spawned a retreat to the office.

Big tech companies such as Disney, Meta, Salesforce, ScaleAI, etc., encourage employees to return to the office as it promotes camaraderie and increased productivity.

We’re seeing something similar across the New Stack portfolio as well. Companies that default in person generally have grown faster and have had less turnover across the staff.

The number of minted unicorns has finally returned to earth, with 11 marking the lowest count since 2017.

Given the fundraising data noted above, this doesn’t serve as a surprise. Fewer growth rounds are being completed, and the market clearing price is still set for later rounds.

As we wait for the later stages to open up again, there are whispers that many previously anointed unicorns will be forced to come back to market sometime this year and will likely lose their unicorn status.

Although highly unlikely, it’s a crazy thought that we could exit 2023 with as many unicorns as we entered with.

Wrapping up

RIP to Gordon Moore. Gordon was the founder of Intel, the man who proposed Moore’s Law, and one of the greatest innovators of our time.