The Shift in Unicorn Yield and Tier 1 Investment Activity

65,475 pre-seed and seed funding rounds have been announced in the United States since 2010.

Our analysis reveals that regional growth of pre-seed and seed rounds has grown precipitously across the United States.

*Aggregate pre-seed and seed growth from 2010. The top number represents the number of financing rounds and the bottom the the percentage of overall growth.

Growth in regions such as the Southwest and Southeast has been especially strong, with both regions notching a 6x increase since 2010.

Although the data is interesting, these findings aren’t overly surprising. While these rounds indicate that startup ecosystems are flourishing across the United States, they don’t provide insight into the quality of the ecosystems themselves.

What is surprising, however, is that analyzing the startups these regions produce reveals that, for the first time, unicorn yield has surpassed its coastal counterparts. And not only is unicorn formation becoming less concentrated, but the firms that have built their legacy from investing in Bay Area unicorns minted during the 2010s are becoming less concentrated as well. Tier 1 firms have taken notice, become more inclusive, and complemented the mecca of tech with a host of alternative geographies (both inside and outside the United States).

So, can we expect the surge in startup activity and investment across the United States to produce a similar, if not higher, quantity of unicorns than the coastal hubs?

The data suggests that the answer is yes.

We analyzed every unicorn founded since 2005 and paired it with data from every pre-seed and seed financing since 2010. In addition to the data that we pulled, we didn’t just look at the rounds themselves but also at who was leading and participating in these rounds.

To complement the quantitative results, we gathered qualitative feedback by going directly to the source and asking some of the most prolific investors & firms what is driving their geographical approach.

Our findings show that NYC and SF will always be the two most important ecosystems (at least for the foreseeable future), but production across other regions is difficult to ignore. Investors and entrepreneurs are leveraging the opportunity for the next wave of unicorns to be produced this decade.

Flight of the Unicorns

Currently, the United States accounts for 497 active unicorns that have been founded since 2005. Of the 497, San Francisco and the surrounding area tally an impressive 234 of them. New York City comes in a distant second place attributing 94 to the count.

Cumulative unicorn yield doesn’t provide insight into which way the winds are shifting, though.

Over the past few years, something interesting has been happening.

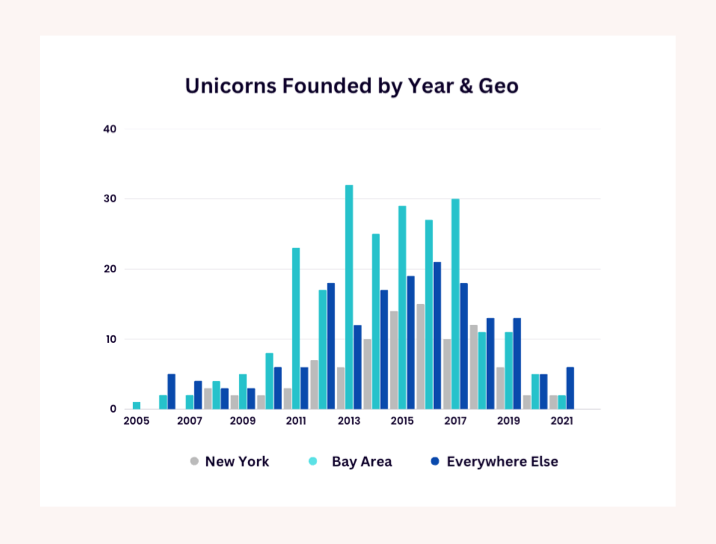

*Location of where unicorns have been founded over time.

If the GIF was too fast to notice, an alternative format of the same data should be clearer.

*Breakdown of where unicorns have been founded over time.

The Bay Area has unequivocally dominated unicorn production. But, for the first time since 2007, regions outside the traditional tech hubs have led the yield of founded unicorns. The bar graph fails to capture how impressive the growth has been. If we look at the same data from Everywhere Else as a function of the total percentage of unicorns yielded, we get the following:

*Percentage of total unicorns located outside of SF & NYC

Although the data is still relatively immature from 2018 onwards (a unicorn takes, on average, 7 years to bake from inception), the leading indicators lead us to believe this trend will continue.

As shown at the top of this post, startup growth across regions outside the traditional hubs has increased rapidly, and so too has capital deployed at Seed.

These findings lead us to believe the unicorn yield in regions such as the Southwest, Pacific NW, etc. is potentially a fraction today of what it could be 5 years from now.

Tier 1 Response

We’re not the only ones to notice the arbitrage between the coasts, though. Firms that have built their legacy backing the most recognized names in tech are taking notice.

Using the same data set, we looked at how Tier 1 investment activity has shifted over time, and this, too, served as a surprise.

*Aggregate number of seed investments made by Tier 1 firms over time.

2022 marks the first year that Tier 1 firms have led more seed rounds outside the Valley than within it.

For some, investing across regions and geographies has always been a strategic focus. One of those firms is New Enterprise Associates (NEA). As far as our data took us back, NEA hadn’t had a single year below 40% of their investments being located outside of SF/NYC. We asked Chuck Newhall, the Founder of NEA, to share his view on how he was ahead of this trend.

“From its inception NEA had offices on both coasts. The firm had very strong historical ties to both San Francisco on Boston the centers of entrepreneurship at that time long before NYC developed into the entrepreneurial center it is today. But NEA’s founders always believed that there were significant entrepreneurial opportunities in other states and regions like Texas, Minnesota (medical devices), and the mid Atlantic. We actually went so far as to have NEA partners or affiliated partners who lived in those locations since we believed you had live close to the companies you backed if you really wanted to be involved and help them. Of course when NYC got hot we opened an office there with senior partners located in the city. Looking for opportunity All across the us and for that matter the rest of the world is not a new thing for NEA. It has been part of the firm’s DNA since inception.”

Boldstart Ventures was another firm that we noticed a high mark for alternative regions, coming in at 50%+. Asking Founder and Managing Partner, Ed Sim, the same question, he echoed something similar.

"Starting out as a firm that no one knew, we had to be different from the beginning, and knew we weren't going to win the Valley. Being focused on developer tooling and infrastructure, we went where the founders were and because of OSS and the cloud, we always believed great founders could be anywhere. With time, we've been fortunate to be at company formation with some now today high profile cos like Snyk and BigID in Israel and a number of others in Europe. Great founders hang with great founders and this spurred significant deal flow over time.”

*Percentage of rounds completed outside of NYC & SF over time.

For others, investing outside the traditional hubs is a recent phenomenon. In asking friends Guru Chahal from Lightspeed Venture Partners and Joe Medved from Lerer Hippeau, here’s what they had to share with the firm’s inclusion of alternative geographies:

“Entrepreneurial talent was secularly moving to additional tech hubs in US - NYC, LA, Seattle, Austin, Miami, parts of mid west - as well as globally - in parts of Europe, Canada, LatAm etc. Covid accelerated this trend significantly. We've opened several new offices in NYC, London, Paris among others, to support these founders at the earliest stages of their journey”

“We've always been bullish on the NYC ecosystem, which itself was really an emerging startup market when Lerer Hippeau was formed a dozen years ago. The market got rolling from a handful of successful entrepreneurs, who became angels and advisors. In addition, the launch of the Techstars accelerator in NYC helped train not only entrepreneurs, but also new investors from the corporate ecosystem. A similar dynamic has since played out in many markets across the US, spawning a new generation of founders. Firms in established markets started paying more attention to these new hubs of activity, and the acceptance of more remote work and diligence with COVID helped accelerate that behavior over the past few years as well.”

Wrapping Up

The decentralization of startup formation and value creation is being proliferated by a multitude of factors:

Technology is proliferating across all sectors and industries. Certain regions are better suited to produce certain types of technology (in a subsequent article, we will explore which regions produce which types of technology).

Democratization of capital between the coasts has spawned new ecosystems.

COVID-19 served as a catalyst to this growth, allowing entrepreneurs to start companies and recruit talent from anywhere. The same can be said on the investment side. With in-person meetings being put on hold, the lens for investors expanded to include regions that were previously not on the radar.

As we look toward the future, we have little doubt about the significance NYC and the Bay Area will continue to play in the tech ecosystem. That said, it’s difficult to ignore the trends and tailwinds that are emerging outside the traditional hubs. The leading indicators suggest that ecosystems outside the traditional hubs could be at the beginning of an inflection and investors are starting to take notice.